👋 Welcome to FWIW by David Tvrdon, your weekly tech, media & audio digest.

🌐 Online version. 👉 Be sure to subscribe, if you were sent this newsletter.

In this edition

💸 A crazy week in finance

📊 Q4 2020 earnings: Apple, Facebook, Microsoft, Tesla

💬 Other tech, media, audio & podcasting news

🆕 Read my regular Friday column for The Fix, this time about the future of audio: The ups and downs of Clubhouse

So, another crazy week

First, some history, even though this all happened over the course of a few days this week:

Members of the r/WallStreetBets subreddit have driven GameStop’s stock prices from around $20 to over $300

They also targeted other unlikely stocks like AMC, Blackberry, and Tootsie Roll, and others (e.g. DogeCoin, see below)

This has resulted in huge losses for big investors who were short-selling those stocks

OK, so what is short-selling?

Short-selling is a tactic used by hedge fund managers and investors who are predicting that a stock’s value will go down. Short-sellers borrow shares of a stock, usually from a broker-dealer, before immediately selling them at the market price.

They must then, at some point, buy back those shares and return them to the lender.

If the stock’s value decreases as they predict, the short sellers will make money, as they buy the shares back at a reduced price, return them to the broker and pocket the difference.

However, if the stock’s value increases, the short sellers must still return the shares. This means buying them back for more than they sold them for, and therefore losing money.

Watch this video by The Verge that explains the whole situation

Some of the main characters were featured in media, but none so much as a Massachusetts man who goes by “Roaring Kitty”. His $53,000 investment in GameStop briefly reached $48 million in value. Here is a feature in The New York Times about him.

How does Robinhood come into all of this?

Robinhood had to raise $1 billion from investors yesterday to help it cover cash demands during the week’s trading frenzy, while traders and lawmakers sharply criticized the online broker for halting some trading in Reddit-touted stocks. In short: The consequences of the mania in GameStop, AMC and other stocks are becoming more concrete — and, in Robinhood’s case, more serious.

The surge in trading forced Robinhood to raise cash. As waves of investors poured into the markets, Wall Street’s central clearing hub, the Depository Trust and Clearing Corporation, demanded billions more in collateral from brokerages to shield it from the volatility. Robinhood, which had already drawn millions from its credit lines to meet margin requirements, turned to existing investors for additional capital so it wouldn’t have to impose further limits on customer trades.

Want to go deeper?

Don’t, says Ranjan Joy, who used to work on Wall Street and left, he gives a pretty good explanation of what is happening and that there are no lessons to be learned.

Or go for this Bloomberg piece: Inside GameStop’s Crazy Week. (+ read the rest of Matt Levine’s stuff, he publishes a daily newsletter called Money Stuff and it’s really good.)

Oh, and if you want to see a movie that looks at a similar (though much much bigger bubble) re-watch The Big Short, currently on Amazon Prime Video.

And, of course, you have to watch Billions on HBO, which is a related but non-realistic show, where they talk a lot about shorting.

+ Watch out for the DogeCoin! (Yes, the stocks have been this crazy.)

CONTEXT: Dogecoin, the popular meme cryptocurrency, hit a new all-time high on Jan. 28 following a meteoric 1,100% gain.

🙏 Liked it so far? ❤️ Support this newsletter by sharing it, thanks!

In other news

TECH

👋 Clubhouse has 2 million users and a $1B valuation. [Axios]

📊 Q4 2020

Apple reported revenue of $111B for Q4 2020, up 21% YoY, and its highest ever. The company's revenue from iPhones increased by 17% due to a 57% increase in China, which has a better developed 5G network. Macs up by 21%, iPads by 21%. Overall, a very good quarter for Apple. [Investor Relations Apple]

Facebook reported revenue of $28B for Q4 2020, up 33% YoY and the company's yearly revenue increased by 22% YoY to $86B. [Investor Relations FB]

Microsoft reported revenue of $43B for Q4 2020, up 17% YoY. The company’s revenue from cloud services contributed around 40% of the overall revenue. Gaming revenue increased by 51% YoY. [Investor Relations Microsoft]

Tesla reported its first full-year profit, $721 million. Tesla’s sales rose about 36 percent to 499,550 cars in 2020. The company reported revenue of $10.7 billion in the fourth quarter, up 45.5 percent from the year-ago period. Its full-year revenue climbed to $31.5 billion, up from $24.6 billion in 2019. [Investor Relations Tesla]

📱 Apple shipped most smartphones in Q4 of 2020. The company returned to the number 1 position with 90.1 million devices shipped, driven by the success of the iPhone 12 series. Samsung moved to number 2 with 73.9 million device shipments and 19.1% market share. Although looking at the whole year, Samsung shipped significantly more phones than Apple, and thanks to the US sanctions the iPhone maker replaces last year’s no.2, Huawei. [IDC]

⚙️ Facebook explained in some detail how the News Feed ranking algorithm works. [Facebook Engineering]

⚔️ The Facebook vs. Apple feud is intensifying. Facebook for months has been preparing an antitrust lawsuit against Apple that would allege the iPhone-maker abused its power in the smartphone market by forcing app developers to abide by App Store rules that Apple’s own apps don’t have to follow. Meanwhile, Tim Cook lit into Facebook during a speech he gave this week at the Computers, Privacy, and Data Protection conference: "We can no longer turn a blind eye to a theory of technology that says all engagement is good engagement,… that does not deserve our praise, it deserves reform," reported Protocol. Guess, who he was talking about. [The Information]

🔍 I did not see this coming, but I agree with Facebook here going against one of the decisions by the Oversight Board. [About Facebook Blog]

💔 Nearly 60 percent of Americans surveyed in a recent poll said that they supported breaking up Big Tech. [Vox]

🛒 Amazon.pl will soon go live. Amazon is continuing its European expansion with the Czech republic rumored to be next. [Amazon Blog]

MEDIA

📩 Twitter joined the newsletter game. The social media company bought Revue, a newsletter platform for writers and publishers. [Axios]

RELATED: Facebook is working on newsletter tools for journalists and writers. It will be part of the Facebook Journalism Project, and Mark Zuckerberg is supportive of the initiative. [NY Times]

📊 Learn how to create an animated viral chart. Flourish.studio’s masters series features in its first installment John Burn-Murdoch’s step-by-step guide on how to create an animated line chart he did for Financial Times and went viral. [Flourish Blog]

📰 Marty Baron, editor in chief of Washington Post is retiring. Baron led the newsroom for eight years. The Post, under Baron, has won 10 Pulitzer Prizes and grew its newsroom from 580 journalists at his arrival to more than 1,000. The paper has not yet named Baron’s successor. [Columbia Journalism Review]

P.S.: Los Angeles Times, Reuters, HuffPost, and Wired are all looking for new editors. Soon, The New York Times will be too. [Axios]

💬 Media Revolutions conference will be a 10-day event. Topics: Media vs. authoritarianism, newsletters, podcasts, cross-border reporting, innovation in the reader revenue model, future of media education. [Schedule]

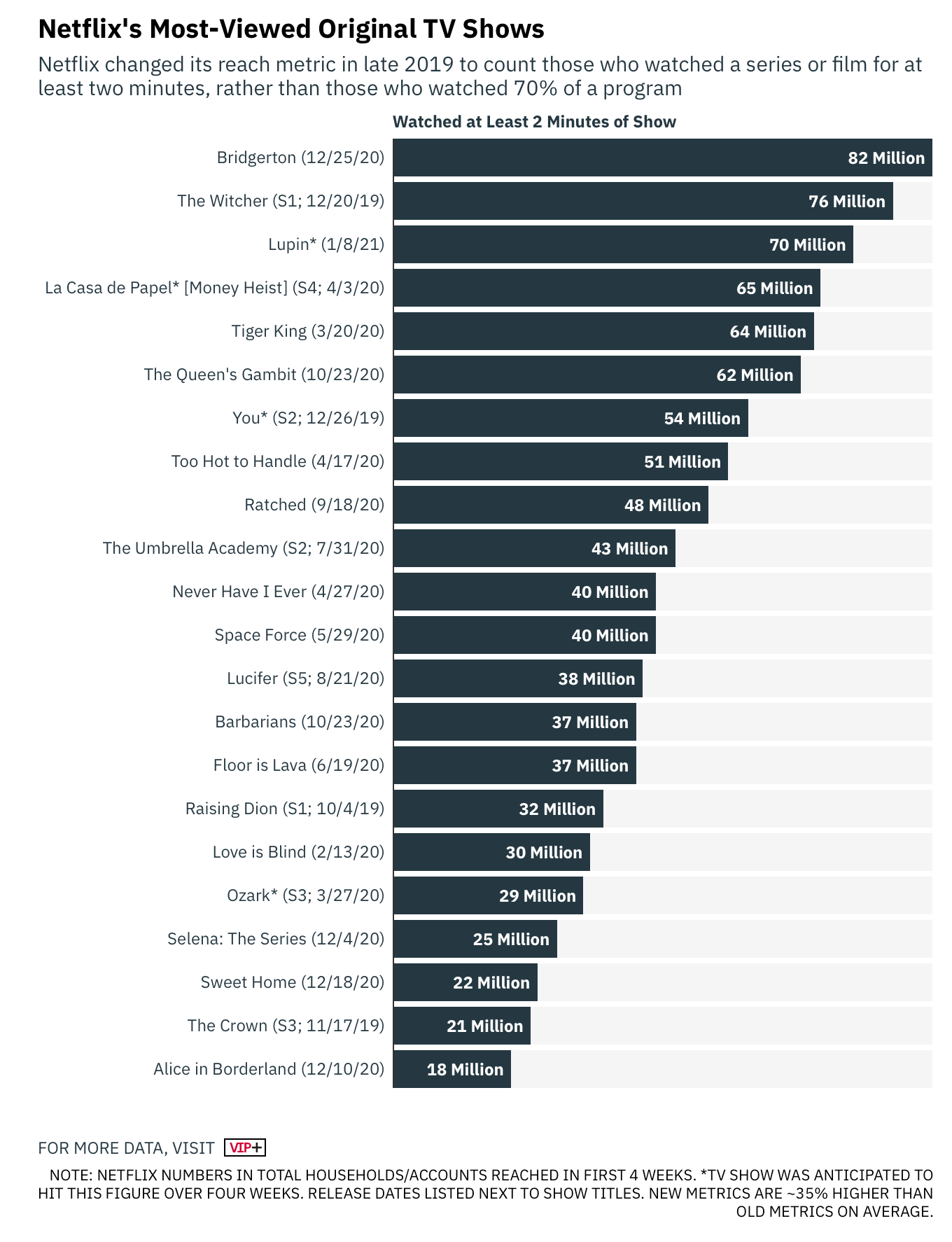

📺 Bridgerton is Netflix's most-watched debut ever. Acquiring Shonda Rhimes was a good deal for Netflix and it is starting to pay off. In the first four weeks, it has been watched by 82 million households. It's reached the top 10 in every country but Japan. [Variety, Lucas Shaw]

RELATED: Apple Studios won ‘CODA’ in record-breaking $25 million sales at Sundance. The Zack Van Amburg and Jamie Erlicht-led studio paid close to $25 million for the film, breaking last year’s recording setting “Palm Springs” sale at the north of $22 million. [Variety]

🧩 How the New York Times Crossword became too big to fail. [Study Hall]

🤦♂️ Peak Instagram design. Yes, pls, add even more functions, icon, buttons…

AUDIO & PODCASTING

🎧 Spotify tests audiobooks. Nine classic audiobooks — including Cynthia Erivo's narration of 'Persuasion' and Hilary Swank's reading of 'The Awakening' — are now available on Spotify. [The Hollywood Reporter]

⏩ HBO is developing a TV adaptation of the ‘Serial’ podcast’s season 3. [Deadline]

📈 How to understand podcast stats (updated). [Podnews]

🎙️ How to market your podcast on Instagram. [Headliner]

🤑 The podcast business is booming, but few are making money. [Axios]

OTHER

👔 How to become a Digital Marketer: 12 Free LinkedIn Learning Courses. 1.6 million digital marketing jobs have been posted on LinkedIn in 2020. Based on LinkedIn’s Economic Graph data, digital marketing is among the top 10 jobs that have the greatest number of openings and have shown steady growth over the past years. [LinkedIn Blog]

Catch me on Twitter or LinkedIn. Was this forwarded to you? 👉 Subscribe over here.